Our blog

FinCEN 114 FBAR 2024

The Internal Revenue Service today reminded U.S. citizens, resident aliens and any domestic legal entity that the deadline to file their annual Report of Foreign Bank and Financial Accounts (FBAR) is April 15. For additional information about filing deadlines, filers...

Understanding the U.S. Exit Tax for Expatriates

If you're not familiar with U.S. taxes, the idea of an "Exit Tax" might sound confusing. Different rules apply according to the date upon which you expatriated, so be sure that you have checked your exact expatriation date. The article is based on the ruling for the...

Form 1040 – Nonfilers and Penalties

Form 1040 is the standard federal income tax form that individuals use to report their income to the IRS. All U.S. persons (US Citizens, GreenCard Holder and Resident Aliens) are required to file a Form 1040 annually, regardless of their income source, the country...

Tax residents in Spain with income from the United States according to the AEAT

Tax residents in Spain with income from the United States according to the AEAT Tax residence A natural person is fiscal resident in Spanish territory when any of the following circumstances occur: They have stayed longer than 183 days in Spanish territory over the...

The Tax Implications of Opening a Foreign Bank Account

For US Citizens and Green Card holders who hold assets with foreign institutions, for whatever reason, the tax ramifications are an area of serious concern. The Internal Revenue Service (IRS) treats money held in foreign banks differently than money held in domestic...

Passive Foreign Investment Company (PFIC)

Passive Foreign Investment Company (PFIC) A foreign entity/form of investment is a PFIC if it meets either the income or asset test described below. Income test. 75% or more of the corporation’s gross income for its taxable year is passive income (as defined in...

Maximizing Resources: A Guide to Utilizing US Tax Consultants.

Navigating the complex world of tax regulations can be a daunting task for many individuals and businesses. This is where US Tax Consultants come in, offering their expertise to help clients optimize their tax strategies and ensure compliance with ever-changing laws....

Guide for Filing US Expat Taxes 2024.

Americans living abroad must still file taxes in the United States. In addition, US expat taxes are more complex. This is because there are specific rules (and benefits!) when filing an American expatriate tax return. But thanks to these benefits, many expats don’t...

Form 5472 is now required for non-Americans that own an LLC in the U.S

Prior to 2017, ownership of a Limited Liability Company (LLC) by a non-American generally did not require the filing of a U.S. tax return with the IRS. Consequently, non-American programmers and other digital nomads that lived and worked outside the U.S. but created...

FBAR filing requirements for a non-resident alien (NRA)

In one of the IRS’s more generous rules, it allows U.S. expats to treat their non-resident alien (i.e. non-American) spouse as a U.S. person for tax purposes (assuming that several conditions are met and a correct application for this particular treatment is properly...

Child Tax Credit 2024: Find Out if You’re Eligible

By Katie Teague CNET, April 27 If you've been waiting for a child tax credit expansion bill to get passed, don't delay any longer. We'll explain what's going and what you should do. The child tax credit -- both the current credit and the one stalled in the Senate --...

When Will the IRS Send Your Refund?

From Katie Teague CNET April 27 adapted by US Tax Consultants Tax season is not over yet, but when should you expect your child tax credit refund? Here's how to find out when you'll get it. Tax season might be over, but if you're reading this, you probably haven't...

The IRS reminds taxpayers to claim 2020 refunds by May 17

By: Wolters Kluwer on May 1st The IRS has reminded taxpayers that time is running out for them to claim refunds for tax year 2020. The reminder says that May 17 is the deadline for claiming those refunds. People who want to claim tax refund for 2020 need to file their...

Modelo 714 Wealth Tax and Modelo 718 Solidarity Tax to Large Fortunes.

Wealth Tax in Spain: modelo 714 Modelo 714 is the Wealth Tax declaration, which assesses the net assets of natural persons residing in Spain. It considers both rights and assets owned by the taxpayer. We must especially consider the economic parameters that determine...

The tax transparency of US LLCs and the tax regime applicable in Spain.

The Spanish tax treatment of US LLCs classified as pass-through entities: sole proprietorships, partnerships, S-Corps and Trusts, are analogous to entities subject to the Spanish income attribution regime (= atribución de rentas), which is the tax treatment of...

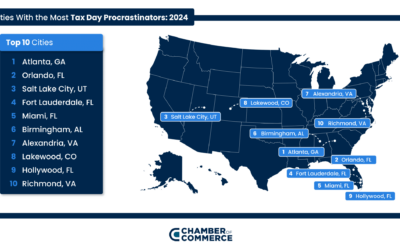

Cities With the Most Tax Day Procrastinators (2024)

For most Americans, filing taxes can be a painstaking process. Considering 42% of Americans say they’d rather endure a dentist appointment than file their taxes, it’s an understatement to say that most people don’t look forward to tax season. This year, tax season...

IRS Backlogs

Why TIGTA Did This Audit Backlogs of tax returns and other types of tax account work resulting from the Coronavirus Disease 2019 Pandemic (Pandemic) have had a significant impact on the IRS and taxpayers. The backlogs continued into Calendar Year (CY) 2023 with...

TESOL SPAIN – Cáceres 2024

TESOL-SPAIN was founded in 1977 as an independent, non-profit making Spanish association of English language teachers. Today TESOL-SPAIN is a nationwide organization with a membership that represents all sectors of English language teaching throughout the country. It...

US Tax Consultants is also a PAE point

The Entrepreneur Service Points (PAE by its initials in Spanish) are responsible for facilitating the creation of new companies, the effective start of their activity and their development, through the provision of information services, documentation processing,...

2024 is the Year to Get Tax Compliant and get the Stimulus Checks

Edited from From 1040Abroad If you’re one of the many Americans who has fallen behind on your taxes, now is the perfect time to get caught up and potentially receive a significant amount of money. It is estimated that 9 to 10 million people who have not yet received...

Recent Comments