por Antonio Rodriguez | Ene 10, 2022 | AEAT, Modelo 720, Sin categorizar

por Antonio Rodriguez | Ene 10, 2022 | AEAT, FATCA, FBAR, IRPF Spanish Tax Return, IRS - Internal Revenue Service, Modelo 720, US Tax Return 1040 / 1040NR

As have done in the past, we plan to have again a new round of Need-To-Know Seminars or information sessions on the “Fiscal Obligations of US Expats living in Spain.” We have been postponing them because of the COVID restrictions and finally we expect to have them...

por Antonio Rodriguez | Dic 12, 2021 | AEAT, Modelo 720

The Spanish Tax Agency published, last month of July, a new Law to Prevent Fraud, specifically referred to the Cryptocurrencies world. They were supposed to develop the ruling before the end of December and since they do noy have enough time to do it, they have...

por Antonio Rodriguez | Feb 18, 2021 | AEAT, Finances, IRPF Spanish Tax Return, IRS - Internal Revenue Service, Modelo 720, Spanish Tax Return for non-residents, US Tax Return 1040 / 1040NR

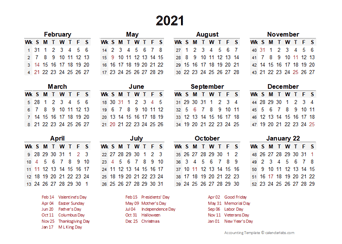

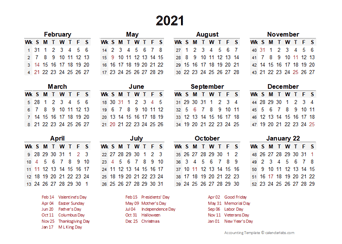

Important Tax Dates on 2021 2021 AEAT & Banco de España IRS & FinCEN HM Revenue & Customs Kingdom of Spain U.S.A. United Kingdom January, 15 Due date for Estimated Tax Form 1040-E 4th 2020 January, 20 Statistical Department of the Bank of Spain Form ETE:...

por Antonio Rodriguez | Feb 18, 2021 | Modelo 720, Spanish Tax Return for non-residents

What is Model 720? Modelo 720 is an annual report that was approved on October 29, 2012 as a modification of the tax and budgetary regulations and adaptation of the financial regulations for the intensification of actions in the prevention and fight against fraud. It...

por Antonio Rodriguez | Ene 10, 2021 | AEAT, FATCA, FBAR, IRPF Spanish Tax Return, IRS - Internal Revenue Service, Modelo 720, Spanish Tax Return for non-residents, US Tax Return 1040 / 1040NR

The 4 fiscal obligations for expats in Spain. All U.S. Citizen you are required to file a U.S. Individual Tax Return every year, wherever in the world they live, reporting your worldwide income, even if you pay taxes in Spain. You must file (1) the Form 1040...

Comentarios recientes